On this day, September 4, 2020, law enforcement declared an unlawful assembly and arrested 27 people after protesters marched through the streets of Portland on to a police building, where officers stood waiting outside.

Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

The rule removal will benefit millions of people

Oregon Governor Tina Kotek issued a state of emergency declaration in response to the wildfire threat. This declaration followed six Emergency Conflagration Act declarations for individual fires within the prior two weeks. The state of emergency was declared to mobilize state and federal agencies and the use of resources to prevent and respond to fires.

At the same time, U.S. Secretary of Agriculture Brooke L. Rollins announced the U.S. Department of Agriculture (USDA) has taken the next step in the rulemaking process for rescinding the 2001 Roadless Rule.

Lt Robert (Rocket) Powell GDO (Ret) has tracked the effect of federal management on the ability of counties, companies in timber and related fields, towns needing to gain economic stability, fire safety in clean forests and more. He is saying this announcement is monumental. The rulemaking opens up a

comment period and the message is relevant to all states benefiting millions of people. Listed are 120 National Forests, but the rules affect all national forests by the same onerous rules in some way. Powell emphasizes, “Removal of roads must be curtailed because road production is more necessary than ever. That will be done with environmental concerns engaged, stewards protect, environmental-ism destroys."

Oregon has the second highest number of

Forest listed out of 41 states:

- Deschutes National Forest

- Fremont-Winema National Forest

- Klamath National Forest

- Malheur National Forest

- Mount Hood National Forest

- Ochoco National Forest

- Rogue River-Siskiyou National Forest

- Siuslaw National Forest

- Umatilla National Forest

- Umpqua National Forest

- Wallowa-Whitman National Forest

- Willamette National Forest

Secretary of Agriculture Brooke Rollins said, “We are one step closer to common sense management of our national forest lands. Today marks a critical step forward in President Trump’s commitment to restoring local decision-making to federal land managers to empower them to do what’s necessary to protect America’s forests and communities from devastating destruction from fires. This administration is dedicated to removing burdensome, outdated, one-size-fits-all regulations that not only put people and livelihoods at risk but also stifle economic growth in rural America. It is vital that we properly manage our federal lands to create healthy, resilient, and productive forests for generations to come. We look forward to hearing directly from the people and communities we serve as we work together to implement productive and commonsense policy for forest land management.”

Powell says, "The ‘Coordination process’ to protect the American population has been weaponized. Oregon Counties are a specific victim of this sleight of hand. The Trump Administration’s Executive Orders are opening up jobs for cleaning forests, for safer conditions that environmental mis-management has ruined.”

The proposal aligns with President Trump’s Executive Order 14192, Unleashing Prosperity Through Deregulation to get rid of overcomplicated, burdensome barriers that hamper American business and innovation. It also supports Executive Order 14153, Unleashing Alaska’s Extraordinary Resource Potential which directs the Forest Service to exempt the Tongass National Forest from the 2001 Roadless Rule. It will bring forest safety and work to revive dying forests all through America

Powell continues, "In 2001, President Bush ordered the Roadless Area Conservation Rule, an environmental policy that largely banned road construction and logging in certain areas of U.S. national forests. Then It was weaponized to remove and decommission roads from travel. The Road closure rule should never have been made law. It must end because of damage to health, species and fire safety".

The USDA Forest Service has published a

notice seeking public comment on its intention to develop an environmental impact statement for the proposed rescission of the rule. The notice details the reasons for rescinding the rule, the potential effects on people and resources, and how national forests and grasslands are managed. The USDA Forest Service published the notice in the Federal Register on Friday, August 29, 2025.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

“For nearly 25 years, the Roadless Rule has frustrated land managers and served as a barrier to action – prohibiting road construction, which has limited wildfire suppression and active forest management,” said Forest Service Chief Tom Schultz. “The forests we know today are not the same as the forests of 2001. They are dangerously overstocked and increasingly threatened by drought, mortality, insect-borne disease, and wildfire. It’s time to return land management decisions where they belong – with local Forest Service experts who best understand their forests and communities. We encourage participation in the upcoming public process. Your input will help to build a stronger, safer future for our forests and the communities that depend on these forests for jobs, recreation, and clean water.”

While the rescission applies first to roadless areas in Alaska, the total 2025 rescission applies to nearly 45 million acres of the nearly 60 million acres of roadless areas within the National Forest System. All of the National Forests are involved. The stewards see the Forests, National or otherwise, as to be tended not destroyed along with many species, plants local small species frogs, butterflies, and the thousand other varieties burned by the environmentalists’ lack of understanding. Wealth distribution is not wellbeing.

Powell encourages the public to take advantage of this opportunity to be the voice of the people.

Comments will be accepted to September 19, 2025. Additional opportunities to comment will occur as the rulemaking process continues. But don’t wait, NGO’s will try to stop this benefit to humanity. Environmental-ism is destructive. The stewards see the forests to be tended not destroyed.

--Donna Bleiler| Post Date: 2025-09-03 13:41:42 | Last Update: 2025-09-04 01:54:36 |

At the state level, conditions have deteriorated, growth has consistently underperformed the national economy, and sharply deteriorating employment conditions

The third quarter

revenue forecast summary suggests Oregon is holding it’s own while the federal government makes adjustments. A weakness in labor-derived income is offset by upward revisions to equity and business components. In general, however, in the absence of the H.R. 1 adjustments the revenue forecast would be little changed if not for the kicker effect. General Fund revenues have been lowered $621.1 million relative to the forecast on which the Legislatively Adopted Budget was based - lower beginning balance, total available resources are down $845.5 million. The consequence is a reversal of the projected unspent balance for the biennium from $472.8 million to -$372.7 million. It should be noted that there are seven forecasts and a final accounting remaining in the biennium that will adjust forecasts. The summary explains:

”Oregon’s economic fortunes are increasingly bound by prevailing national trends. The silver lining of this connection is that while Oregon has underperformed national trends related to output and labor conditions of late, a slowing but still growing national economy should provide a lifeline to the state and thus avert a sustained contraction. Furthermore, robust financial market performance to date—despite slowing growth and tariff pressures—is set to support one of the most volatile sources of state revenue: capital gains taxes. As such, the latest translation of economic conditions into a revenue forecast does not change significantly—at least prior to adjustments related to the federal tax law changes in H.R. 1—as a cooler outlook for labor-generated income taxes is offset by firmer expectations related to capital gains.”

Governor Kotek’s interpretation is one in defense of bad policies that aren’t utilizing what the federal government is offering. Instead, millions are being spent to challenge authority and maintain bad policy. She states, “More Oregon families are experiencing tougher financial situations — not by chance, but because of the economic uncertainty coming straight from the Trump Administration. From reckless choices on trade to broken promises on getting control of prices, working families are falling further behind. With President Trump and Congressional Republicans cutting fifteen billion dollars from essential services over the next six years, and being responsible for reducing state funding right now by an additional $888 million, the damage is here.”

However, the forecast summary actually discredits the Governor’s claim,

“Major sources of uncertainty pertaining to tariffs, federal fiscal policy and tax reforms have been resolved, or at least diminished, during the summer months. This alone should remove a significant damper off hiring, investment and production.”

“Forecasters project improving outcomes for 2026 and 2027 supported by tax cuts, (mostly) stable tariffs and lower interest rates, but flagging growth over the next few quarters increases the risk of destabilizing labor market and overall business conditions.” The Governors response to a promising national forecast is to keep Oregon bound in the past to policies that are not working even with huge tax increases. “While D.C. plays politics, I will stay focused on doing what we need to do to stay ahead…. All of us need to be nimble and look for ways to make our state dollars go further when delivering for Oregonians. I believe in the resilience of our state and our ability to work together to take care of each other.”

The Forecast Summary states:

“At the state level, conditions have deteriorated to a greater degree: growth has consistently underperformed the national economy, the unemployment rate has risen by nearly a full percentage point, and perhaps most alarming, recent revisions show sharply deteriorating employment conditions across a broad array of industries. The most severe declines in employment have occurred in the manufacturing, construction, financial activities, wholesale trade, private education and information sectors. The broader state economy is likely to avoid recession so long as the national economy holds up, but if the state-level employment declines—should they persist through the second half of the year— warrant attention as potential warning flags of sector-specific recessions.”

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Senate President Rob Wagner (D-Lake Oswego) followed Kotek’s lead, but was basically a plug for the Special Session: “It is now increasingly clear — on top of tariffs and economic uncertainty, the Trump administration’s signature piece of legislation will hurt everyday Oregonians and harm the state’s ability to provide needed public services. There is a lot of work ahead of us. We need to pull together to invest in Oregon’s infrastructure and economy, continue to support vital public services, and protect Oregonians from the chaos of the federal administration.”

Senate Majority Leader Kayse Jama (D–East Portland, Damascus, Boring) centered her remarks around President Trump: “Today Oregonians have the clearest measure yet of the harm to our state brought by President Trump’s budget bill and unstable economic policies: they will end up costing Oregon more than $800 million over two years. We know Trump's tariffs continue to drive inflation—raising costs of everyday goods and threatening good-paying jobs—while tax breaks go to billionaires, funded by cutting access to food and health care for Oregon's struggling families. Oregon Senate Democrats will move forward ready to confront the budget challenges ahead under this vast disinvestment by the president and his enablers in Congress.”

The Federal Reserve Bank reports that 31 states are expected to gain real income from the effect of tariffs, with some seeing increases as high as 1.7%. The remaining 19 states could experience losses exceeding 2%. These disparities arise from differences in each state’s reliance on trade, sectoral employment, and exposure to tariff-affected supply chains. States dependent on agriculture or services—sectors projected to lose employment and output—may face greater economic strain. However, H.R. 1 rescinds IRA unobligated funding programs and adds them to the USDA budget baseline, outlaws climate goals for agriculture, and lifts caps on households that rely on 75% from agriculture. This can depend on how well a state can shift enough to stateside markets as foreign markets move stateside.

Blaming the Big Beautiful Bill that was just passed for a forecast based on passed production is a shift on focus. Reduction in the Medicaid and SNAP payments aligns, at least in part, to criminal users, which the state will benefit from if they are off the benefit list. There are other benefits that Oregon refuses to us, such as energy development on Federal lands. States with significant federal land holdings see changes in energy policy, including expanded oil, gas, and coal leasing on federal lands, and reduced fees for renewable energy projects.

What are Oregon Democrats doing? They increased SNAP use for noncitizens, pay for attorney fees for noncitizens, restricts farming practices, and puts regulations on agricultural farming. Every press release exposes their goal to oppose the Trump Administration regardless of public opinion or the greater good for the state.

--Donna Bleiler| Post Date: 2025-08-27 23:18:28 | Last Update: 2025-08-27 23:52:41 |

Poll shows 82% against funding ODOT with tax increases

In response to1300 testimonies posted a day earlier, all in opposition, the Joint Interim Committee on Transportation Funding started the hearing on Monday with an initial group in support of Governor Kotek’s proposed LC 2 tax increases. Immediately after this initial group concluded, Governor Kotek sent out a press release of all her support. Riddled with quotes from testimony, she had to have copies of these testimonies to send out the press release within a minute of their conclusion.

"Oregonians depend on safe roads to go about their lives. We have to keep our roads safe through winter weather, rain, and wildfire threats," Governor Kotek said. "Without additional funding, we would be abandoning Oregon families from Brookings to Joseph who are counting on us to step up and keep roads maintained all year round." She didn’t wait on her press release to hear the families struggling now that couldn’t manage another cost-of-living increase.

Through a mixture of testimonies, almost all supporters testified in support of their one area of interest and neglected the consequence’s of the total package. Those in opposition spoke more to the total package of increased taxes from gas tax to employment tax to giving DAS responsibility to raise gas taxes for fee equalization, and the mismanagement of funds at ODOT.

Counties and cities across Oregon also face transportation funding shortfalls. LC 2 maintains the state's commitment to local road safety, sending 30% of State Highway Fund revenue to counties and 20% to cities. Counties want to see their share of the pot increased to respond to emergencies, fill potholes, and plow snow from roads that Oregonians rely on during winter storms.

“Oregon counties are responsible for the largest share of Oregon’s public road system,” said Mallorie Roberts, Legislative Affairs Director of Association of Oregon Counties (AOC). “AOC estimates that without new revenue, over the next five years, more than 4,500 miles of county roads will go without critical maintenance work and will quickly deteriorate beyond repair; over 800 miles of county roads will go without needed reconstruction, and 169 county bridges will miss essential maintenance. AOC and the Oregon Association of County Engineers and Surveyors (OACES) support Legislative Concept 2 and urge the legislature to work with their partners to develop a comprehensive statewide transportation package in the 2027 legislative session.”

Morgan Niles, member of Oregon AFSCME Tillamook County Local 2734, said: “This proposal ensures that local governments can protect our communities by fixing landslides, filling potholes, repainting fog lines and replacing guardrails.”

Umatilla County Commissioner Dan Dorran said: “The state/county/city partnership may be complicated, but we have a shared, long-term commitment to the common goal of providing to all of our constituents an above average transportation network.”

Mixing the trucking tax in the package is a slight of hand that creates a methodology that will allow DAS to raise the gas tax to keep fee equalization in check without voter input. Unions were strong in addressing the “longstanding overpayment issue and modernizing our taxing methodology to be more in line with the rest of the country,” said Jana Jarvis, President and CEO of the Oregon Trucking Associations.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

There is no indication that a middle ground is being sought after. Many asked about other wasteful fund expenditures that could easily be allocated to ODOT for road maintenance. Some even suggested funds that could be rerouted. The employment tax is proposed to be doubled to fund transit services. Tri-Met is funding $30,000 to undocumented to buy their first home, which is coming from ODOT.

The emergency that justifies a special session should not include funding of housing by Tri-Met, and be limited to the created emergency to fund the Oregon Department of Transportation's (ODOT) maintenance and operations budget. The new revenue is paired with accountability measures that provide greater oversight into ODOT's spending and operations. Some objected to giving ODOT more funding until they were audited and revamped for accountability. Why is ODOT funding housing for Tri-Met? The opinion is that ODOT failed with the funds allocated in 2017 and shouldn’t be rewarded for poor management.

Legislative Concept 2 includes increased funding for transit providers across the state. The services maintained by the increased funding are crucial for Oregon's seniors, veterans, and working families.

“Without new resources, tens of thousands of Oregonians, students, workers, seniors, and people with disabilities stand to lose reliable transportation,” said Allan Pollock, General Manager of Cherriots. These same people were also mentioned as those on fixed income that cannot afford a cost-of-living increase.

"This proposal is just the first step toward building a transportation system that works for everyone, for years to come," Governor Kotek continued. "We have to address the crisis at our front door before we can move forward."

It was evident that the unions were at the Governor’s “front door.” Democrats made an effort to get supporters to testify. These were mostly union and government employees that could appear under their job description. One man drove hours just to say he’d submit his testimony in writing.

Those in opposition didn’t have the luxury to take off work for the very reason they oppose the increases – they live on a tight budget and fear how they will manage if the gas tax goes up and trickles down raising the cost-of-living. Channel 8 news poll indicates 82% of Oregonians are against taxing to fund ODOT. Who do you think Kotek will invite in her "front door"?

--Donna Bleiler| Post Date: 2025-08-25 23:30:44 | Last Update: 2025-08-26 00:23:17 |

Gas tax increase explodes to 46-cents per gallon

[

Editor's note: Updates added with my apologies]

Is Governor Kotek thinking the public wouldn’t read her slight of hand maneuver, raising the gas tax increase 12-cents per gallon in HB 2025, then reducing it to 6-cents to make voters think she is giving them a break. Republican legislators should have caught it, but they are more interested in the message they will send to voters if they participate to meet quorum, and now they are being punked. Yes, they are victims of being "humiliated in disrespect".

LC 2: Section 17 (1) To compensate this state partially for the use of its highways,

an excise tax hereby is imposed at the rate of [34] 46 cents per gallon on the use of fuel in a motor vehicle. Passage of the 34-cent gas tax in 2017 included increases to 40-cents effective January 1, 2024.

About eight Republicans are still planning to increase their disrespect to voters by giving quorum to the special session. It doesn’t take Common Core math to figure out that ODOT’s half of the 6-cent increase is needed to give ODOT employees a 6% pay increase. While private sector jobs are moving out-of-state or just plain closing doors, state jobs keep multiplying in a cook-the-books effect to hide the truth from the public.

Representative Alek Skarlatos (Canyonville) said on I Spy Radio, that Unions have government so locked up that making ODOT accountable is impossible without breaking that strong hold.

Nothing can hide the pain in the pocket book, especially for low-income families who will be hit the hardest. Even buying a car is hit by the 12-cent gas tax increase used in calculating the license tax.

Property values are down and Oregon ranks number 46 in the highest foreclosure rates in the U.S. It could very well be the top foreclosure state were it not for state legislation providing some protection.

Oregonians will have another blow on their pay checks.

LC 2 bill doubles the employment tax deduction. Channel 8 news poll indicates 82% of Oregonians are against taxing to fund ODOT. All legislators should be concerned how that will translate into votes if the special session proceeds.

Governor Kotek’s fingerprints are all over the

LC 2 bill. The bill shifts the Transportation Director to be appointed by the Governor and “serve at the pleasure of the Governor.” In 2030, ODOT can raise the gas tax to fund whatever the governor wants. The accountable funds are those dedicated to a project and everything else is free game.

Even more troubling, LC 2 says that beginning in 2030, if the Legislature fails to act, the Department of Administrative Services (DAS) could hike fuel taxes and weight-mile rates administratively. That means unelected bureaucrats — not your elected representatives — would have the power to raise your taxes.

It is also questionable whether this special session meets the requirements of an emergency required to call a special session. LC 2 is 91 pages of restructuring for accountability, which does not necessitate an emergency. Republican leadership has already proven ODOT can be given the necessary funding from the Emergency Board without tax increases. Leadership and legislators seem to be shooting themselves in the foot attempting to raise taxes and damaging their reputation when they should be appeasing Oregonians in preparation for federal funding cuts.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

There will be a standoff on August 29-30 – Unions at the south door of the capitol vs Oregonians at the north door. Unions are there representing the 500-700 employees the Governor is using as bait, or maybe they are there to protect ODOT’s negotiated pay increases regardless if their workers will also feel the pain of a 6-cent gas increase and an employment tax increase.

The north side will be the tell-all for the next election – Time to Take Oregon Back. Oregonians have had enough of the chaos. Bring signs and rally for:

- No more new taxes

- No more sanctuary policies for illegal migrants

- No more land grabs and government overreach

- No more corruption and backroom deals with unions

- Demand better education for forgotten children

- Stop radical gender surgeries on minors

Contact legislators asking them to refuse quorum and forget the bribes. Bribed funding may help one project in the district, but LC 2 will hurt every person in the district and state.

--Donna Bleiler| Post Date: 2025-08-22 17:24:31 | Last Update: 2025-08-23 19:23:59 |

ICE subpoenas records of five rapists due for parole

Oregon’s sanctuary state law initially was in defense of citizen’s rights when in 1977 four Polk County officers launched an interrogation on Mr. Delmiro Trevino while dining at a restaurant in Independence. Only after Trevino was identified as a long-time resident of Independence was he left alone by the police.

The program of these four was discovered that Polk County had a de facto policy to drive around Latino neighborhoods and round up people they thought were undocumented immigrants. The sheriff’s office, at the behest of Immigration and Naturalization Service (INS) would detain people of color, until INS could pick them up for deportation.

Trevino brought a lawsuit that was dismissed based on the parties stipulating that the policy of INS did not have authority to authorize local law enforcement agencies to make arrests of individuals on the sole charge of illegal entry or violation of immigration status without the presence of INS officers. It took until 1987 for the legislature to agree and passed HB 2314, which prohibited racial profiling by law enforcement to detain or detect or apprehend persons without cause, and later added prohibition of using resources on persons whose only violation was being in the country without documentation. That law cracked the door to be amended into a sanctuary state law.

The 2025 legislative session took up another expansion and attempted to pass

SB 820 and

SB 821 to give sanctuary to sex offenders, which died in committee.

Unanimously passed was

SB 277, which expands sanctuary laws on the backend and brings back deported criminals under warrant. This will counter extradition of criminals and use Oregon taxes to bring back criminals for trial. If not convicted, there is no provision for them to be returned to ICE for deportation. If convicted, Oregon pays for their incarceration, and when they are free, there is no provision to turn them over to ICE for deportation. That is what Marion County is facing now.

Marion County has initiated a federal lawsuit asking for clarification whether they should follow state or federal law when it comes to immigration enforcement. The case revolves around release of parole records for four individuals to be paroled (convicted with rape, kidnapping) whom they believe to be undocumented immigrants. Federal authorities have set a deadline of August 18 for the county to submit these records, which include details about the individuals involved. This legal action follows subpoenas issued by ICE to the county on August 1, which sought records pertaining to four individuals convicted of serious offenses, including multiple counts of rape, sexual abuse, and kidnapping/robbery. Court documents also mention a fifth subpoena directed at an individual whose identity has not been established.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The subpoenas ICE sent to Marion County requested information including each person’s address, phone number, birth records, driver’s license number, employer’s address while on parole and information about bail.

In a statement, Danielle Bethell, chair of the Marion County Board of Commissioners, said the county reached out to both federal and state officials to get clarity, but the legal path still remains uncertain. “Marion County is prepared to either provide or withhold the requested records based on what the Court determines the law requires. Obviously, we want to keep dangerous people out of our community and off of our streets. We also want to make sure the state won’t come after our community and sue us if we provide the requested records to the federal administration.”

--Donna Bleiler| Post Date: 2025-08-20 21:07:42 | Last Update: 2025-08-20 23:15:17 |

Oregonians wait for the next move

Judicial Watch is a not-for-profit, educational organization that filed suit on October 2024 on behalf of the Oregon Constitution party against the State of Oregon and the Secretary of State for violating the National Voter Registration Act (NVRA) by not maintaining the Oregon voter rolls. That action was challenged by a motion to dismiss and the response, promised on June 18th for a decision in two weeks, didn’t come through until nearly seven weeks later. On August 5th, U.S. District Judge Michael J. McShane finally released his 23-page “

OPINION AND ORDER” granted in part and dismissing in part.

Perhaps the

DOJ’s Statement of interest made him pause when he read it. It begins: “This case presents important questions regarding enforcement of the National Voter Registration Act, ... for the limited purpose of addressing the requirements under the NVRA for states to maintain and make available for public inspection certain records concerning the implementation of programs and activities conducted for the purpose of ensuring the accuracy and currency of official lists of eligible voters”.

“Accurate voter registration rolls are critical to ensure that elections in Oregon are conducted fairly, accurately, and without fraud,” said Assistant Attorney General Harmeet K. Dhillon of the Justice Department’s Civil Rights Division. “States have specific obligations under the list maintenance provisions of the NVRA, and the Department of Justice will vigorously enforce those requirements.”

The case doesn’t refute the public’s increased concern that “the integrity of elections” is impaired by “the opportunity for ineligible voters to receive and cast ballots” which undermines “confidence in the integrity of the electoral process”. This could discourage “participation in the democratic process”; and cause “fear that their legitimate votes will be nullified or diluted by unlawful” votes. It also doesn’t deny the cause of those uncertainties, which is that “Oregon failed to conduct a general program to remove ineligible voters from voter registration rolls”.

The suit was originally structured on two premises. The court concluded that only the Constitution Party has plausibly alleged standing. This denied the standing of the individual voters named in the suit in the first count. It is troubling to consider that their possible disenfranchisement by potential fraud has no value according to the judge.

The court accepted, however, the plaintiffs’ allegations that their confidence had been undermined, “finding those allegations not speculative because the fear already existed and not generalized because there was “no indication those fears were shared by all”. That acknowledgement came as a surprise to local researchers who have already heard these reactions from the public. These investigators, who spent hours categorizing the anomalies in the voter rolls and verifying accuracy and applicable law, agree that “all” is currently a very large number.

Notable admissions from the opinion includes “the Constitution Party’s ability to contact eligible voters is impeded “because Defendants’ failure to conduct list maintenance required by the NVRA causes Oregon’s voter rolls to have many more outdated and ineligible registrations—both on its active and inactive voter lists—than they otherwise would.”

”As a result, the Constitution Party “waste[s] significant time, effort, and money trying to contact voters . . . who are listed on the rolls but who no longer live at the registered address or who are deceased.” The costs and decreased results have forced the Constitution Party “to adjust its activities.”

The Constitution Party raises one allegation that gave the Court pause: “The voter rolls also allow the Constitution Party to keep track of its own members whose registrations have become inactive.” Of all the alleged harms, this one rises above a mere ‘frustration-of-purpose argument.’ If the Constitution Party cannot monitor its members, it is plausible that it could lose its status as a minor party and no longer be entitled to limited liability or to nominate candidates. “Accepting the allegations in the FAC as true and construing them in favor of Plaintiffs, the Constitution Party has plausibly alleged that outdated or inaccurate voter lists impair a core function of that organization. The Court finds that the Constitution Party has properly established standing.”

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Ominously, Judge DeShane concludes, “the Constitution Party has adequately pled that its core-functions, which involve monitoring voter registration and increasing voter participation, have been hindered by non-compliance with the NVRA’s list maintenance provision. The Court therefore declines to dismiss the Constitution Party’s claim on a “zone of interest” argument at this time”.

The second count considered whether Judicial Watch “failed to provide adequate notice before commencing a lawsuit on the public records claim”, and when such notice would have been due. The discussion demonstrated the ambiguity of Oregon election law which lists various if-when possibilities which are confusing. The judge did not make a response as to which one was the definitive answer.

The most interesting claim is from a responsive email from the Secretary of state’s office that was sent in September, estimating that 5,000 hours of labor would be required to complete one aspect of Plaintiffs’ public records request for “a list of the names and addresses of all persons to whom notices ... were sent, and information concerning whether or not each such person responded to the notice”.

It said, “After internal review, we have identified significant additional labor cost to provide a full data set of returned voter notification cards (VNCs). Counties have historically used slightly different processes and have latitude to define some process steps in our current system. Researching this historical information would require significant consultation with county officials, including some who may have retired, and significant additional review of data by the SOS after such consultation. We estimate this work would take approximately 5,000 hours to complete due to the level of customization required for each of the 36 counties in Oregon.”

The county clerks bill their time at $100 per hour so the cost adds up to $500,000, but the final total could be even higher. At that point, Judicial Watch did not respond, which confused the SOS. “Instead of replying to this correspondence, Plaintiffs sent a notice letter on July 10, 2024, threatening to commence a lawsuit because “Oregon is not complying with its list maintenance obligations”. Judge McShane explained how this led to his dismissal of the second count, without mentioning the ridiculously high estimate (the definition of estimate implies a judgment, considered or casual, that precedes or takes the place of actual measuring or counting or testing out).

Now that everyone has thrown down the gauntlet, the public eagerly awaits the next episode of this legal maneuvering, and the costs to Oregon and national taxpayers continue to go up as each participant responds.

--Virginia Hall| Post Date: 2025-08-14 11:47:35 | Last Update: 2025-08-14 17:22:50 |

Governor Kotek lays the burden on taxpayers ignoring the problem

Oregonians sighed relief when the legislative session left the Transportation bill in committee lacking support. But instead of reforming ODOT, Governor Tina Kotek has officially called the Legislature back to Salem on August 29th to take another swing at a transportation package. Governor Kotek is pitching this as a way to stop layoffs and restore basic services, but the truth hasn’t changed: ODOT’s financial problems are not the result of revenue shortages--they’re really the result of long-term mismanagement.

Kotek released her

Transportation Funding Proposal for the special session proposing the need for increased taxes all about the 2% slice of ODOT's massive budget that goes to road maintenance. That’s where the layoffs are coming from, and that’s where the public feels it most. Instead of addressing inefficiencies, the Governor insisted on immediate layoffs for 500 employees before the end of the biennium to create a crisis and sympathy for those families. Then, in response to public outcry, she extended layoff timelines to September 15th and called for a special session proposing taxpayers pay more to keep a broken system on life support.

Oregonians are seeing through the coercion and threats of layoffs to garner support. Holding 700 workers hostage to get legislators to vote for funding in the special session is coercion and illegal under ORS 163.275. Using her powers to threaten layoffs and then to delay layoffs exposes the lack of an emergency for the layoff announcement. For that reason alone, the unethical posturing should offend all legislators into a no vote. Proposing increases three or more years down the road without justification leaves Oregonians with a stanch in their nostrils.

The special session's focus hasn't just shifted from the comprehensive overhaul of the transportation system to securing immediate funds to prevent further service degradation and job losses, but it's raising over $538 million plus millions that hasn't been calculated, to plug a $325 million hole. There’s even a .1% payroll tax increase thrown in for good measure, which Kotek opposed when Salem voted it down.

To add a layer of polish, the plan includes some accountability provisions: a performance audit, a revamped advisory committee, and a project dashboard, but none of it changes the fact that this is yet another short-term fix to a long-term problem in terms of ODOT's funding model. Doesn't accountability include transparency? Kotek is focused on 50% of the 6-cents increase to pay for the deficit, but that is insignificant to the total tax proposed. How will the remainder be used? Recent U.S. Supreme Court Chevron case requires legislators to be explicit in authorizing non-elected agencies to administer laws. We don't yet know of a bill number or specific wording the Democrats will introduce, but it is unconstitutional for the Governor to submit a bill.

Kotek's proposed plan for the special session on August 29 will include more than necessary in these key elements:

- Gas tax increase: A 6-cent per gallon increase, raising the state's gas tax from 40 cents to 46 cents per gallon raising an estimated $144 million. The increase gas tax revenue would be split with 50% going to the state transportation department, 30% to counties, and 20% to cities.

- Vehicle registrations for MPG vehicles, mopeds and motorcycles will increase by $42 estimating over $260 million increase.

- Electric vehicle (EV) and 40+ high-MPG vehicles will also have a surcharge increased of $30.

- Base Title fees will increase by $139 for a total charge of $216, the surcharge will not change.

- Payroll tax dedicated to transit would double from 0.1% to 0.2% amounting to $134 million increase estimated.

- Road User Charge (RUC), a per-mile charge for electric vehicles and hybrids in the coming years.

Kotek makes the same mistake made in 2021 with over funding a 10-year plan and now the money is gone with very little to show for it. She states, "In order to take meaningful steps to modernize how we pay for transportation in the future, the RUC program, as envisioned in House Bill 2025, will be included with a delayed start date. Mandatory RUC would begin on the following

dates for the following types of vehicles paying the RUC won't pay the supplemental registration fees:

- 7/1/27: Existing EVs

- 1/1/28: New EVs

- 7/1/28: Hybrids/plug-in hybrids

Besides these delays, tolling will be paused in previous transportation legislation, except for a replacement bridge on Interstate 5.

She proposes delays in heavy vehicle rates increases to 2029 to address the imbalance in rates and do an update of the methodology that addresses the imbalance before the next Highway Cost Allocation Study.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Kotek is confident that this plan will pass at the special session. Her proposal, when fully implemented is still the $11-15 billion tax increase originally introduced in HB 2025 that was totally rejected by Oregonians. Even with increased accountability, the Governor seems to be tone deaf. Oregonians have clearly stated - no new taxes. The unethical posturing should offend all legislators into a no vote. Proposing increases three or more years down the road without justification leaves Oregonians with a stanch in their nostrils. It's one thing to win a vote when it's fair and square, but unethical manipulation is illegal and everyone associated cannot hide from their public record.

House Republican Leader Christine Drazan (R-Canby) says, “The governor’s tax package is going to hurt struggling families. Oregonians will be paying more but getting less—no new lanes, no improved bridges, just higher taxes. House Republicans proposed using money from the state’s Legislative Emergency Board to protect maintenance and preserve essential jobs that keep our roads safe, but the governor rejected any plan that didn’t raise taxes. Her plan to cut maintenance workers was dangerous and wrong, and her push to raise costs at the pump is extreme and out of touch. She should listen to Oregonians, work across the aisle and pursue a measured approach to the transportation needs of the state without forcing the largest transportation tax increase in Oregon’s history.”

Much has been said about Republicans not showing up for the special session that would block any movement and potentially force some reforms. But this isn't just a Republican pushback. These tax increases will hit everyone living in Oregon. If you aren't hit directly by a tax, it will raise food prices, along with every thing transported to stores or online shipping. It will raise housing costs. Oregon is ranked fourth in the nation for under producing housing, and with an increased cost of transportation, Kotek is shooting herself in the foot. It's a good bet she has her eye on the kicker to fill the gap.

--Donna Bleiler| Post Date: 2025-08-10 12:55:46 | Last Update: 2025-08-10 16:18:17 |

Oregon is fortunate to not have projects in progress

The Trump Administration has canceled plans to use large areas of federal waters for new offshore wind development.

Oregon’s South Coast has had a long fight against the

2021 House Bill 3375, and against Representative David Brock Smith, who voted for the bill. HB 3375 established a plan for offshore wind energy development and set a goal of 3 gigawatts of offshore wind energy by 2030. Despite his vote, Smith continues to tell his constituents he opposed offshore wind development claiming the bill slowed down the process.

President Trump signed a temporary executive order in January 2025 halting offshore wind lease sales in federal waters. It paused approvals, permits, and loans for wind projects. The Interior Department issued directives to end preferential treatment for wind and solar facilities, labeling them as unreliable and foreign-controlled energy sources.

Oregon has turned its back on many of the President’s Executive Orders putting Oregon at risk for funding and partnerships that would benefit Oregonians. Oregon State University and the Pacific Marine Energy Center conducted a study on how government agencies and private organizations deal with public perception of potential offshore wind development. The Institutional Review Board at OSU reviewed and approved the research in the Coos Bay area.

The Federal government designated more than 3.5 million acres for wind energy areas, the offshore locations deemed most suitable for wind energy development. The Bureau of Ocean Energy Management (BOEM) is now rescinding all designated wind energy areas in federal water, announcing an end to setting aside large areas for “speculative wind development.”

BOEM said it was acting in accordance with Trump's action and an order by his interior secretary to end any preferential treatment toward wind and solar facilities, which were described as unreliable, foreign-controlled energy sources.

The Biden administration last year had announced a five-year schedule to lease federal offshore tracts for wind energy production. Attorney Generals from 17 states and the District of Columbia filed a lawsuit challenging Trump's executive order halting wind energy leasing and permitting for wind energy projects. States involved in the coalition includes Arizona, California, Colorado, Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New Mexico, New York, Oregon, Rhode Island, Washington and Washington, D.C. They say they’ve invested hundreds of millions of dollars collectively to develop wind energy and even more on upgrading transmission lines to bring wind energy to the electrical grid.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Oregon is fortunate for a strong opposition to not have offshore projects in progress on the 195,000 acres designated offshore of the southern Oregon coast.

In June 2025, a federal judge in Massachusetts expressed skepticism about the states’ request for a preliminary injunction, asking for more specificity on the harm caused and legal violations. The judge collapsed the injunction motion, and the case was set for a hearing on a potential dismissal.

--Donna Bleiler| Post Date: 2025-08-10 11:03:12 | Last Update: 2025-08-10 16:18:41 |

Grand Round instigates veto on Willamette Falls Trust

Oregon Governor Tina Kotek provided notice to the Legislature that she is considering vetoes of the following bills and budget items from the 2025 legislative session. The Governor make the release pursuant to Article V, Section 15b(4), of the Oregon Constitution. She has until August 8, 2025, to take final action.

Policy bills:

House Bill 3824 - Allows physical therapists to practice dry needling.

Senate Bill 976 - Allows an individual to verify whether cattle are pregnant without holding a valid license issued by the Oregon State Veterinary Medical Examining Board under certain circumstances.

Senate Bill 1047 - Requires Curry County and the Water Resources Department to expedite review of applications for use on specified lands.

Reason for potential vetoes: The Governor and her team will continue to review these bills and consider perspectives for and against to inform her final decision.

Budget line items in

House Bill 5006:

- Willamette Falls Trust - $45 million in lottery bonds

- House Bill 5006, Section 110(15) Project limitation to grant funds to Willamette Falls Trust

- House Bill 5006, Section 108 Cost of Issuance limitation

- Senate Bill 5531, Section 38 Lottery Bond Authorization

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Reason for potential veto:

The Governor supports the opportunity of creating public access to the natural wonder that is Willamette Falls, from both sides of the falls. She is exercising her due diligence to understand more fully the use of these dollars and wants to hear more from all interested parties. She has been a supporter of creating public access to the falls in the past and is committed to dedicating public funding that builds that access in the most equitable, responsible manner possible. As a steward of tax dollars, the Governor is specifically interested in how past allocations, including $12.5 million in state lottery bonds and $20 million in Metro parks and nature bonds, will be or have been spent before approving an additional $45 million. She looks forward to the conversations ahead to inform her final decision.

YourOregonNews.com reported on The Willamette Falls Trust — a partnership of the Confederated Tribes and Bands of the Yakama Nation, the Confederated Tribes of Siletz Indians, the Confederated Tribes of the Umatilla Indian Reservation and the Confederated Tribes of Warm Springs — initially asked lawmakers for $50-75 million to acquire about 60 acres of land on the West Linn side of the falls. The Willamette Falls project, which was first announced to the public in 2023, would bring public access to the falls and restore the surrounding uplands along the river. The trust’s vision includes public walkways as well as “spaces for interpretation, cultural events, community programming, viewing structures and other public amenities, all informed by Indigenous-led design.”

The trust was initially the Willamette Falls Legacy Project, which stopped work in 2022 on a plan to build public walkways on the Oregon City side of the falls when the Confederated Tribes of the Grand Ronde, one of the original trust members, withdrew as both a project partner and a trust member.

The Grand Ronde, which now owns the Blue Heron Paper Mill property overlooking the falls from Oregon City, asked Gov. Tina Kotek and state leaders to hold off on granting funds to the trust for the Inter-Tribal Public Access Project. “Proponents are presenting this project as returning land to Oregon’s tribal nations, however the Trust excludes Grande Round, which is the Tribe of record in the area, and includes an out of state tribe,” Grand Ronde Tribal Council Chair Cheryl Kennedy wrote in the letter to Kotek. Is Grande Round asking to be placed in the trust after they sabotaged the project in 2022?

To comment on these vetoes,

message Governor Kotek here.

UPDATE August 7, 2025

- Willamette Falls responded to Kotek's demands taking them off of the veto list.

- Senate Bill 976 - Allows an individual to verify whether cattle are pregnant without holding a valid license issued by the Oregon State Veterinary Medical Examining Board under certain circumstances. See veto letter here.

- Senate Bill 1047 - Requires Curry County and the Water Resources Department to expedite review of applications for use on specified lands. See veto letter here.

- Every bill from the 2025 session that the Governor signed or vetoed, including House Bill 3428 which was signed, as well as accompanying signing letters, can be found here.

--Donna Bleiler| Post Date: 2025-08-10 10:29:34 | Last Update: 2025-08-10 16:19:12 |

Independent journalism fights for truth against political pressure

The Oregon Elections Division's recent decision against Senator David Brock Smith reveals a systematic

pattern of political coercion that extends far beyond simple campaign finance violations. The

investigation, which found Smith failed to report $4,968 in radio airtime contributions, has helped

uncover a web of donor influence, media manipulation, and constituent deception that challenges the

integrity of an Oregon Senator.

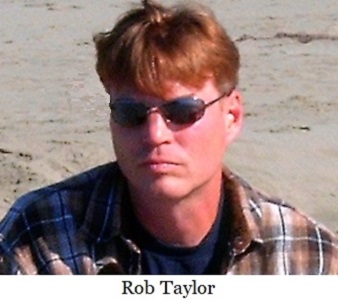

The case centers on Smith's unreported 92 three-minute segments on KWRO radio in January 2024,

valued at $18 per minute, which he received after pressuring the station owner to cancel Rob Taylor's

show. Taylor was a local radio show host who had been on the air for over five years.

However, the story behind these broadcasts reveals a calculated quid pro quo arrangement in which a

station owner was coerced into silencing a critic. Then the politician applying the pressure was rewarded

with unchallenged airtime to spin his story.

The Silencing of Rob Taylor

The controversy began when Smith appeared on "The Rob Taylor Report" radio show on KWRO, owned

by Bi Coastal Media. During the interview, Taylor confronted Smith about his campaign contributors and

his support for offshore wind turbine projects. Smith's response was not to address the questions

honestly but to demand the show's removal from the air.

Smith did not like an interview he was part of on the radio show. Smith demanded that the owner of the

radio company, Mike Wilson, remove the show from the air because he didn't like the questions being

asked by the host, Rob Taylor.

Wilson capitulated to the political pressure, canceling Taylor's contract and removing the show from the

airwaves. Then, after silencing a prominent critic of Smith's, Wilson provided Smith with 92 three-minute segments worth $4,968 to present his version of events without challenge or rebuttal.

The $150,000 Question

The questions that prompted Smith's retaliation centered on a wealthy California Democrat who

contributed $150,000 to the rural Republican senator's political action committee. The donor

contributed $125,000 in annual increments of $25,000 over 7 years, while his deceased wife had

previously contributed $25,000. The donor in question made his money managing hedge funds in China,

which was an interesting aspect to the story, because Smith is on the Oregon Chinese Council.

Smith's inability to explain why such a substantial sum would flow from a California Democrat to a safe

Republican seat in rural Oregon raised immediate red flags. The donation becomes even more

suspicious when viewed in light of Smith's voting record on environmental legislation.

In 2021, Smith voted for Oregon House Bill 3375, which established a roadmap for offshore wind energy

development and set a goal of 3 gigawatts of offshore wind energy by 2030. Despite this vote, Smith

repeatedly told his constituents he opposed offshore wind development.

Video Evidence Contradicts Public Statemen

Video evidence from the Oregon Legislature shows Smith giving testimony in favor of the offshore wind

bill and supporting the use of wind turbines. When confronted with this contradiction during the Taylor

interview, Smith claimed the bill "slowed down the process" rather than acknowledging it created the

framework for massive wind energy development off Oregon's coast.

"Smith said the bill slowed down the process, but instead, it created a roadmap and set a goal of 3 GW of

offshore wind energy by 2030," sources confirmed. "It was a blatant lie."

The deception runs deeper when examining Smith's funding sources. Records show Smith has accepted

money from PACs funded by green energy companies involved in solar and wind energy projects.

Significantly, the last remaining company bidding on offshore wind leases in Coos and Curry Counties

was among the green energy companies that contributed to a PAC that has contributed money to

Smith's PAC.

Coordinated Intimidation Campaign

Following the confrontational interview, Smith's wealthy donor threatened to take legal action against

the radio station if Taylor's show were to remain on the air. The donor objected to having his name and

that of his deceased wife mentioned in connection with their political contributions, despite these being

public records.

This coordinated pressure campaign succeeded in silencing Taylor, who was deplatformed and unable to

respond. The timeline reveals the calculated nature of this arrangement: Smith appeared on Taylor's

weekly radio show for a 30-minute interview, didn't like the tough questions, pressured Wilson to cancel

Taylor's show, and then received 92 three-minute segments to spin his story without Taylor being able

to respond.

The station's owner canceled the host's contract and gave Smith an inordinate amount of time to spin

the story to the public on the same station where the show was broadcast.

The story was mostly forgotten until the Secretary of State found the Senator guilty of violating

campaign finance law.

Smith’s Lousy Voting Record

Smith's actions reveal a pattern inconsistent with conservative principles. He maintains low voting

scores with organizations like CPAC and the Republican Liberty Caucus of Oregon, while simultaneously

accepting funding from green energy interests that directly benefit from his legislative votes.

In the recent legislative session, Smith voted for a controversial bill, SB 147, concerning the Elliott State

Forest. It was the final nail in the coffin for education ever receiving funding from timber harvests, and

turns the forest into a research forest where the state will sell carbon credits for sequestration efforts.

Smith voted for the Fire Mapping Bill, SB 762, in the 2021 Regular Session, only to have to vote to repeal

it in the 2025 Session because it would have put financial burdens on the property owners due to higher

insurance rates and new regulations. His voting record is marked by bills that include funding for DEI.

Smith even voted for the Menstrual Dignity Act, which directed schools to put tampons in the boys’

bathrooms.

There is a Grassroots Response Emerging

Smith faced the most contentious primary challenge in any state Senate district due to his questionable

character. Smith spent $250,000 against his primary opponent, who spent only $25,000. It may have

illustrated the influence of wealthy donor networks in insulating politicians from accountability, but it

ultimately cost him and his donors a lot of money.

Despite the suppression efforts, Taylor's show survived by moving to podcasting, where it continues to

expose political corruption. Citizens in Smith's district are beginning to organize within the local

Republican Party structure to demand accountability.

People are getting involved in the local chapter of the Republican Party in Smith’s district. People are

working to change the leadership through participation in the local party's central committee. Hopefully,

they will establish standards for their candidates, as they do not want to be fooled again.

The Secretary of State's investigation and the potential for a subsequent fine may provide vindication for

Taylor's original reporting, proving for independent journalism can ultimately prevail against political

intimidation.

--Staff Reports| Post Date: 2025-08-10 10:06:35 | Last Update: 2025-08-10 16:19:46 |

Oregon climate is right for a successful recall

A formal petition (SEL 350), to recall Oregon Governor Tina Kotek, was officially recorded by the Oregon Elections Division on July 27, 2025. The petition cites allegations of failed leadership and violations of her oath of office. The petition, filed by William Minnix of La Pine, accuses Governor Kotek of prioritizing the interests of undocumented immigrants over law-abiding Oregonians and claims that her administration has neglected key constituencies such as veterans, low-income families, and victims of crime.

Minnix, who is a disabled veteran, in his official statement, argues that Kotek’s policies have created a burden for Oregonians by failing to comply with presidential executive orders, and contributing to the loss of federal funding. He claims the governor’s refusal to enforce federal mandates forces Oregon taxpayers to makeup for funding shortfalls, thereby contributing to financial instability within the state. The petition asserts that this ongoing behavior reflects an abuse of gubernatorial power and a failure to uphold constitutional obligations.

The petition states that no paid circulators will be involved in collecting signatures, indicating it will be a grassroots-style campaign led by volunteer efforts. Under Oregon law, they will have 90 days to gather over 280,000 valid signatures from registered voters. The probability has turned in favor of a recall in the last 20 years. Less than 50% of Oregonians think the state is headed in the right direction. The NIV registered voters, which now exceeds both major parties, only recorded 30% that think the state is headed in the right direction.

Governor Tina Kotek, a Democrat who took office in January 2023, followed Governor Kate Brown as one of the top three worst governors in 50 States. Her failed priorities has been at the center of several high-profile policy debates, including housing, homelessness, and public safety. Even though the state has shown improvement after the pandemic, it couldn't go much lower and was virtually a bounce-off the bottom when Oregonians were freed from pandemic mandates.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The state of Oregon has attempted multiple recall efforts against public officials, but successful recalls involving statewide elected officials is rare due to the rigorous signature requirements and time constraints. With less than 50% supporting the state's direction, this filing indicates ongoing dissatisfaction and underscores the continued polarization surrounding immigration policy and state-federal relations.

This is not Kotek's first brush with a formal workplace complaint. In 2019, during her tenure as House Speaker, a complaint filed by former state representative Diego Hernandez, alleged that Kotek used political pressure and threats, though the investigating attorney concluded her actions did not violate legislative workplace rules. It was investigated and discussed in a legislative committee hearing in October 2022. This matter drew significant scrutiny but did not constitute a recall effort.

The next steps in the recall process will be to see if the grassroots can gain enough momentum to advance to the ballot. A signature-gathering rally will take place August 29 in combinations with the protest to the Special Sessions. Kotek aims to push through an unpopular ODOT funding Bill, which has the potential to inspire volunteers.

--Donna Bleiler| Post Date: 2025-07-31 16:09:02 | Last Update: 2025-07-30 22:51:39 |

Low-income protection from shut-off masks the need for rate increases

Oregon Governor Tina Kotek signed

HB 3792, which will double the existing size of Oregon's Oregon Energy Assistance Program (OEAP) from $20 million to $40 million. Governor Kotek claims this increase to OEAP will help low-income Oregonians by providing financial assistance to prevent shut-offs of their residential electricity service. But does it?

While the OEAP may have doubled the amount available to assist low-income families, the bill also doubles the maximum payment a low-income household or business would pay from $500 to $1000.

The increase to the OEAP will come from customer rates, which are limited to 2.5% without legislative approval, and the maximum payment amount may also be changed if it exceeds the 2.5%.

John A. Charles Jr., President and CEO of Cascade Policy Institute, stated in testimony, “HB 3792 will make most ratepayers worse off by taxing them to increase funding for the OEAP.” He suggested an offset by reducing the Renewable Portfolio Standard (RPS) that is scheduled to increase “clean energy” purchases by 25% in 2025. The cost to ratepayers for PGE’s 2025 forecasts costs $74.7 million, a surcharge of 3.4%. The total estimated cost, 2013-2025 is $565.8 million. Further, in 2021 the legislature required that PGE and PacifiCorp completely decarbonize their systems by 2040, which the RPS is now redundant. This single act would more than double the OEAP and still make all ratepayers better off.

With all the flexibility to the HB 3792, it seems misleading for the Governor to say this bill will help low-income Oregonians. In fact, it does the opposite by allowing an increase in the maximum low-income families pay out, plus participating in rate increases. The Governor’s press release states: “Under HB 3792, the average residential ratepayer’s bill will increase approximately .70 cents per month and large industrial users will pay a maximum amount of $1,000 per month, up from a current cap of $500 per month. In addition to doubling the existing OEAP capacity, these additional ratepayer charges for residential ratepayers will be indexed each year to help keep up with inflation.”

HB 3792 actually states: Section 1 (d) [The commissioner shall] “Ensure that no customer pays more than [$500] $1,000 per month per customer site for low-income electric bill payment and crisis assistance.” It is not limited to large industrial users. Besides raising the maximum, those receiving assistance will still pay rate increases to fund the program. Further, there is no ties to an index to keep up with inflation as claimed, which is another rate increase if it does exist.

Over the last four years, low-income Oregon ratepayers have faced dramatic spikes in their residential electricity bills. During 2024 there were nearly 58,000 residential shut-offs in Oregon among PGE and Pacific Power customers – the highest number on record. It is debatable whether raising the customer payout amount to $1,000 will protect customers from shut-off or increase the number that can’t pay their bill.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Rep. Tom Andersen (D - South Salem), chief sponsor of HB 3792 said: “Disconnections should not be a collection mechanism for our most at-risk Oregonians.” If HB 3792 was intended to give added protection from disconnection, it does not add to what ORS 757.698 already says: “In consultation with electric companies, investigate and may implement alternative delivery models to effectively reduce service disconnections and related costs to customers and electric companies”.

“Our Oregon Energy Assistance Program has a proven track that we should all embrace. By doubling the amount available under this program, HB 3792 will likely cut the number of annual shut-offs in half. Many single income families with babies or young children face significant risks when their electricity is cut off,” said Representative Mark Gamba, (D – Milwaukie), a co-sponsor of the bill.

HB 3792 will double the amount of funds available for Community Action Agencies to distribute funds and help prevent disconnection of residential electricity services. What that means to ratepayers can only mean a rate increase.

--Donna Bleiler| Post Date: 2025-07-27 22:45:35 | Last Update: 2025-07-27 23:53:53 |

Read More Articles